1. Buy gold bullion

2. Buy gold exchange traded funds

3. Buying gold derivatives

4. Buy jewellery

5. Buy shares in a top-producing gold mining company

6. Buy shares in a junior company exploring for gold

1. Bullion

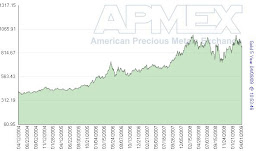

Owning gold bullion is both simple and complicated. It is simple because you can go to any bullion exchange in any major city and purchase as much as you can carry. Bullion can be purchased in units as small as one tenth of an ounce (coins, bars) or as big as a 400 oz. gold bar (currently selling for $269,040.00 and weighing a hefty 800 pounds!)

Your investment gains will be determined by rises and falls in the spot market price plus whatever fees the exchange charges where you purchased your bullion.

In some cases, you can purchase the gold and pay an extra fee for storage of the gold at secure premises. Therein lies the complicated part of owning physical gold.

If you accumulate gold at your home, you increase the risk of losing your entire investment to theft every time you add to your hoard. But if you pay storage fees, the return on your investment is negatively affected.

Incidentally, if you store your gold at the exchange, you receive a certificate confirming your ownership of the amount of gold you've purchased. This is in fact exactly how the first paper currency came about.

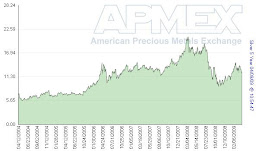

2. Gold-Backed Securities, Exchange Traded Funds

The second way to invest in gold is sort of like owning bullion, but you don't need to concern yourself with the storage and security of the actual gold--that is handled by the company that sponsors an Exchange Traded Fund (ETF).

ETFs are traded on all major exchanges around the world. The number of units you own in an ETF directly corresponds to an amount equal to the dollar value of each unit in gold, plus whatever management fees are involved.

3. Gold Derivatives

A gold "future" is a contract to either deliver or receive a certain quantity of gold on a certain date at a certain price. Futures are a form of "derivative" investment, and are attractive because of the leverage that can be realized because only a small percentage of the commitment is required to be on account at the time the contract is purchased or sold.

This leverage means that you can gain control of much greater quantities of gold than you could if you just bought physical gold or ETFs. But the downside exposure is equally great.

Futures prices are determined by the market's perception of what the carrying costs--including the interest cost of borrowing gold plus insurance and storage charges--ought to be at any given time. The futures price is usually higher than the spot price for gold.

Whereas futures are firm obligations to buy and sell gold, "options" are the right, but not the obligation, to buy ("call" option) or sell ("put" option). The cost of such an option depends on the current spot price of gold, the pre-agreed price (the "strike price"), interest rates, the anticipated volatility of the gold price and the period remaining until the agreed date.

The higher the strike price, the less expensive a call option and the more expensive a put option. Like futures contracts, buying gold options can give the holder substantial leverage. Where the strike price is not achieved, the option is not exercised and the holder's loss is limited to the premium initially paid for the option. Like shares, both futures and options can be traded through brokers.

4. Jewellery

The first use for gold besides as money was as jewellery. Today, there are few people in the civilized world who don't own and regularly wear some form of gold as personal adornment. In some cultures (India especially) it is a predominant form of wealth display and accumulation.

Though not typically purchased as an investment, gold in jewellery form can appreciate substantially over time--especially if it is designed by someone whose fame elevates the demand and thus the price for their work.

Well preserved antique gold jewellery can also command prices exponentially higher than its original value.

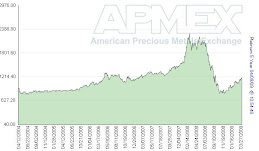

5. Gold Producer Shares

The top five gold producing companies in the world today are:

1. Barrick Gold Corp. (NYSE: ABX)

2. Newmont Mining Corp. (NYSE:NEM)

3. Anglo-Gold Ashanti Ltd (NYSE:AU)

4. Gold Fields Ltd (LSE:GOF)

5. Harmony Gold Mining Ltd (NYSE:HMY).

Purchasing shares in these companies provides leverage to the upside if the gold price rises, as these companies' stock prices can rise much higher, when gold is gaining, than gold itself rises. The downside to investing in large producing companies like this is they can also fall farther than gold in bear markets.

Another risk of investing in large producing companies is the sudden dilution or devaluation that will occur if one company tries to take over another. A classic example of this is the case where ex-Goldcorp CEO Rob McEwen publicly opposed the merger of the company he built with Glamis Gold. The $8.6 billion all-stock deal was the second largest gold deal ever, after Barrick's acquisition of Placer Dome.

He was extremely disappointed, as the largest non-institutional shareholder of Goldcorp, when the share price dropped by 27% on the announcement of the acquisition, and is currently still 20% below Goldcorp's price before the announcement.

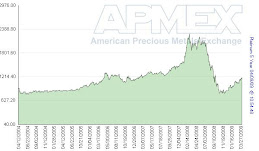

6. Junior Exploration Shares

Widely considered to have the greatest potential leverage to the price of gold, the vibrant junior exploration sector is in the sixth year of a spending boom, as investment banks and senior producing companies acknowledge the role of juniors in discovering the deposits that become tomorrow's mines.

Over half of the world's junior exploration companies are organized, financed and listed in Canada on the Toronto Venture Exchange, one of the world's top performing exchanges in the last five years.

Junior mining companies are typically very small and relatively thinly traded compared to the producing seniors, but here is where the real money is made.

A case in point: Aurelian Resources Corp. This company's stock went from CA$0.61 on March 28, 2006, to a breathtaking $40 in November of the same year! Anyone who invested $10,000 in Aurelian in that time frame would have taken home a whopping $655,737.70, for a gain of 6,457% in just eight months.

Aurelian Resources was just another junior mining company in 2003, with a portfolio of properties in Ecuador, of all places. Ecuador had never had a major discovery, and many institutional investors considered the country politically unstable. That didn't stop Dr. Keith Barron and his partner Patrick Anderson from staking 38 square kilometers.

Drilling began the same year, and decent results propelled the company to $2.25 by the end of the year. Nothing much happened after that until April 2006, when the company announced the astonishing drill intersection of 4.14 grams of gold per tonne over 237 metres, equivalent to a 52 story skyscraper. Well, the stock took off, and delirious investors rejoiced.

Now obviously this doesn't happen every day, but with an estimated 1,200 junior companies exploring for gold around the world today, another Aurelian can happen at any moment.

I recommend looking for junior mining companies with savvy management, a proven track record and a decent land package in a geopolitically safe country. You need to make sure you are properly positioned.

Tuesday, April 14, 2009

Subscribe to:

Comments (Atom)